The January 2024 debut of 11 spot Bitcoin ETFs marks a significant milestone in the convergence of cryptocurrency and conventional finance. This pivotal moment, overcoming prolonged regulatory challenges, particularly with the SEC, signifies cryptocurrency’s growing mainstream acceptance.

TL/DR Summary:

- The Significance of Bitcoin ETFs: Marked a huge milestone by providing a regulated investment vehicle for Bitcoin, aiming to bridge traditional finance and cryptocurrencies.

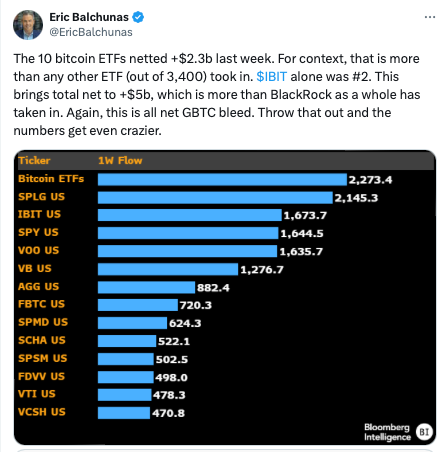

- Performance in the first 5 weeks: Attracted over $5 billion in net inflows, underscoring stronger interest than even the most bullish members of the Bitcoin community predicted.

- Global Impact and Market Dynamics: Significant inflows into Bitcoin ETFs contrast with outflows from traditional gold investments, hinting at Bitcoin’s rising status as a store of value.

- Future Outlook: Growing support from Wall Street and favorable macroeconomic conditions, alongside the potential for innovative derivative products, signal a bullish future for Bitcoin ETFs, enhancing Bitcoin’s integration into mainstream investment strategies.

The Significance of Bitcoin ETFs

The approval of these ETFs, following intense legal disputes and the crypto market’s maturation, offers a regulated, mainstream investment avenue into Bitcoin. It aims to broaden Bitcoin’s adoption among retail and institutional investors by providing exposure to its price movements in a familiar and regulated setting, thus simplifying the complexities and risks tied to direct cryptocurrency ownership. The launch not only underscores the industry’s evolving legitimacy but also introduces a safer, more accessible investment method for traditional investors wary of the regulatory uncertainties and operational risks of direct crypto investments. This development could significantly influence future financial markets, showcasing the potential for cryptocurrencies like Bitcoin to become integrated into the global financial fabric and sparking further innovations.

Performance & Global Impact of Bitcoin ETFs

The introduction of spot Bitcoin ETFs has not only been a landmark event for investors seeking exposure to Bitcoin through traditional financial instruments but also marks a pivotal moment in the broader narrative of digital assets challenging traditional stores of value, such as gold. The significant inflows into these ETFs underscore a growing confidence in Bitcoin’s dual role as both a speculative investment and a credible store of value.

In the wake of their launch, these ETFs have seen substantial inflows, highlighting their immediate impact on the market. For instance, BlackRock’s iShares Bitcoin ETF, in particular, captured a significant portion of these inflows, with a single day’s investment totaling over $224 million. This surge of interest contrasts sharply with the movement of funds in traditional gold markets. Data shows a marked divergence between investments in Bitcoin and gold, with Bitcoin ETFs and exchange-traded products (ETPs) attracting considerable inflows while gold ETFs have experienced net outflows since the beginning of the year.

Analysts from ETC Group and Ryze Labs have pointed to these trends as indicative of Bitcoin’s potential to usurp gold as the primary store of value. The movement of funds suggests a growing investor sentiment that favors Bitcoin’s utility as both a ‘risk-on’ investment and a safe haven asset, a sentiment that could significantly disrupt gold’s long-standing status.

The year-to-date net flows into global Bitcoin ETFs and ETPs, which have risen notably since February, further reinforce this sentiment. This shift is partly attributed to a slowdown in outflows from Grayscale’s converted GBTC fund, suggesting a stabilization in investor interest towards Bitcoin-based investment products.

Despite the current market cap of global gold ETPs being approximately three times larger than that of Bitcoin’s ETPs and ETFs combined, the ETC Group’s Head of Research, André Dragosch, anticipates that the increasing inflows into Bitcoin ETFs could see Bitcoin’s market cap potentially leapfrog that of gold within the next two years, primarily through price appreciation.

This transition period, marked by significant inflows into Bitcoin ETFs, highlights the cryptocurrency’s growing acceptance and legitimacy as a store of value. As these trends continue, the long-term impact could see Bitcoin establishing itself as a prime store of value, challenging and potentially disrupting gold’s traditional role in the global financial system.

Future Outlook

The evolution and impact of Bitcoin ETFs are poised for a transformative phase, buoyed by increasing support from Wall Street and the broader financial ecosystem. The infusion of traditional financial institutions into the Bitcoin ETF market is expected to sustain and amplify daily demand, particularly in the wake of the anticipated Bitcoin halving event in April. This unique combination of reduced Bitcoin supply and heightened institutional involvement suggests a scenario where demand consistently outstrips the creation of new Bitcoin, potentially leading to significant price appreciation.

The macroeconomic landscape further bolsters the bullish outlook for Bitcoin and its ETFs. As global economies navigate through periods of lower interest rates and the ongoing devaluation of fiat currencies, Bitcoin’s allure as a non-sovereign store of value becomes increasingly compelling. The enhanced accessibility to Bitcoin exposure through ETFs in the U.S. market opens the floodgates for a diverse spectrum of investors seeking hedge against inflation and currency devaluation. This democratization of access aligns with a broader bullish sentiment for Bitcoin, as it stands to benefit from macroeconomic trends favoring alternative assets.

The current state of Bitcoin ETFs, with investments mainly coming from institutional and retail investors, is just the beginning of what could be possible in terms of financial innovation. The creation of these ETFs sets the stage for various new derivative products and opportunities for investment in Bitcoin through other publicly traded funds and securities.

This expansion not only opens up new ways to invest in Bitcoin but also weaves it more tightly into the broader world of traditional financial products and strategies. As the Bitcoin ETF market grows, the focus is moving beyond just accepting Bitcoin to integrating it strategically and innovatively into the financial ecosystem.

Looking ahead, Bitcoin ETFs are expected to play a key role in diversified investment portfolios, benefiting from a wide range of financial products that take advantage of Bitcoin’s unique features.

This shift towards greater integration, supported by favorable economic conditions and the increasing involvement of traditional finance in the cryptocurrency space, marks the beginning of a new phase where Bitcoin becomes a fundamental part of mainstream investment approaches.